Fraud, Ponzi Schemes and Terror Financing: A Story About Banking In Nigeria

There is a problem with Nigerian banking, and it's worse than you think. Much worse.

In May 2022, shortly after my story about Chinese loan sharks in West Africa went up, a number of new tips and leads started trickling in. It looked at first, as though a follow-up story would emerge, focusing on how some Nigerian banks still offer banking services to illegal loan sharks despite CBN regulations expressly forbidding this. Wema Bank - unsurprisingly - was the most regular offender in this category, lending its support to multiple illegal loan sharks up until as recently as the time stamps in the images below.

As I trawled through the leads and my own mounting pile of untold story ideas sitting on my Google Drive however, I started to realise something - there was a much greater issue at play here than a few banks bending KYC rules to bank some customers that ought not to be banked. These were borderline unbelievable stories - stories about aggressively fraudulent behaviour by Nigerian banks presented with evidence that was as devastating as it was undeniable.

What is more, these were not stories about a few “bad eggs” in the Nigerian banking sector. Pretty much all of Nigeria’s major banks were implicated, albeit to differing extents. In the interest of brevity, an editorial decision was made to tell the 4 most disturbing stories in no particular order.

There is a story about collusion with regulators to cheat customers and brazenly steal their property. There is a story about illegal, unauthorised account openings which potentially expose customers to an entire world of pain and liability. There is even a story about brazen collaboration with ponzi schemes and illegal investment programs.

Most alarmingly, there is a common denominator of regulatory weakness and complicity, if not outright collusion across all the stories, which culminates in a story about inflows from Qatar potentially financing terrorism in Nigeria for well over a decade. While working on this story, I reached out to no fewer than 6 financial institutions and regulators who were implicated in the maze of documents and testimony I went through.

As always, they had nothing to say.

WEMA, UBA And The Unwanted Accounts: Nigeria’s Wells Fargo Moment?

In 2016, a scandal broke out at Wells Fargo Bank, which at the time was the world’s largest bank. It emerged that over 3.5 million accounts had been secretly opened for customers without their knowledge and authorisation, in response to unrealistic in-house sales and marketing targets. Staff were incentivised to open as many accounts for their customers as possible, and the bank knowingly looked the other way when basic KYC protocols such as customer permission were breached.

In response to the scandal, Wells Fargo fired over 5,000 employees and paid over $3 billion in penalties under a settlement announced by the US Justice Department in 2020. Given the amount of damaging publicity the scandal received, it became an opportunity for banks and banking regulators around the world to review and tighten their operating practices to avoid getting caught up in a similar mess. In Nigeria however, it was treated not as a cautionary tale, but as inspiration for a potentially even bigger brewing scandal.

From May 2022 for example, hundreds of tweets like this began appearing:

Apparently, to celebrate the 5th anniversary of Wema Bank’s digital banking division ALAT, the bank had set a target for its sales team that could either be described as quite ambitious or entirely insane, depending on which side of the fence you stand on. The target, the bank said, was to open 1 million new accounts in one day. For reference, Nigeria had about 134 million bank accounts in 2021, which meant that Wema wished to increase this number by almost 1 percent in just 24 hours.

Even more incredibly, when the bank would later go on to announce that it actually somehow achieved this target, it somehow did not raise an eyebrow.

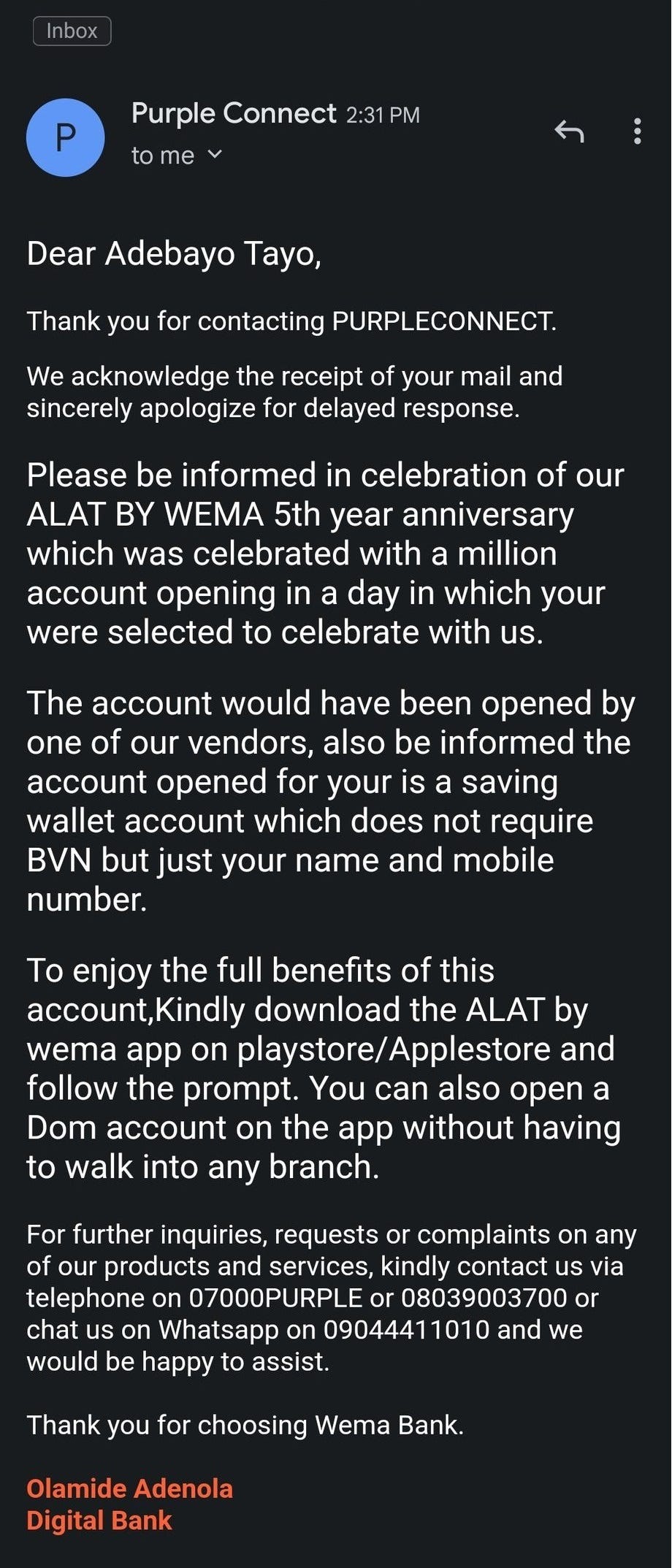

Apart from some excellent work by Olalekan Fakoyejo of Ripples Nigeria, the potential severity of the financial crime that had just been perpetrated on thousands - possibly hundreds of thousands - of Nigerians went completely unreported. In some instances, the bank openly admitted to some of these new “customers” who raised a challenge, that they had been illegally onboarded without their knowledge and consent “because someone with their information thought they will be a good fit.”

When this particular gentleman reached out to the bank via email to pursue the issue further, he got the following response.

Putting aide the disingenuousness of claiming that a customer has nothing to be worried out because an account fraudulently opened using his identity is allegedly not linked to his Bank Verification Number (BVN), this email also failed to deal with an equally pressing issue which he reiterated below.

In other words, there is a clandestine market for private information of Nigerians that Wema Bank apparently has access to. What is more, it is not just Wema Bank. Other banks have also been accused of unauthorised account openings, but perhaps it is the example of UBA that illustrates the sheer depth of criminality and fraudulent behaviour that increasingly characterises the relationship between Nigerian banks and their customers.

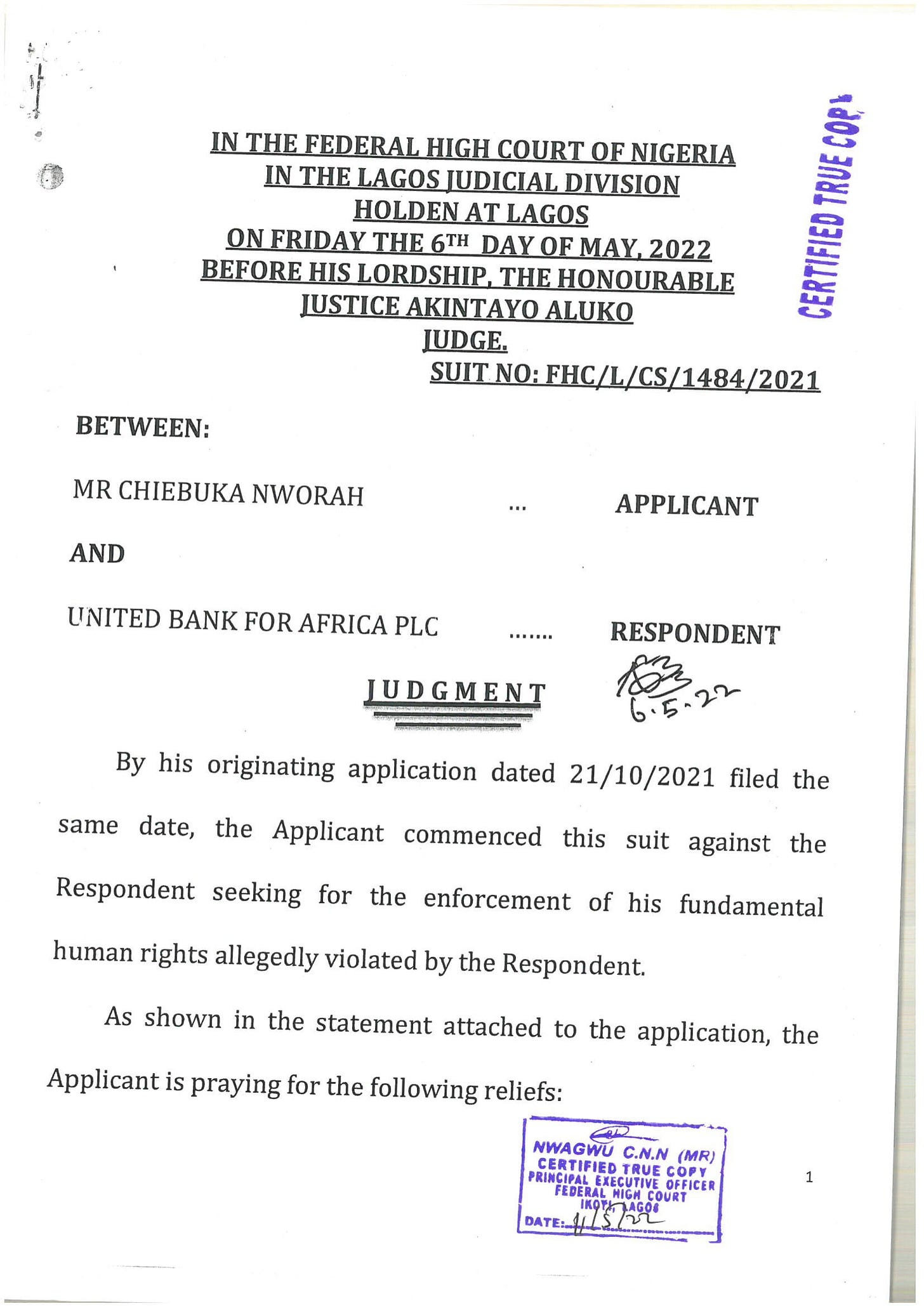

This particular story is taken from a case file at the Federal High Court in Lagos, where on May 6, 2022, Justice Akintayo Aluko became the first Nigerian judge to issue a ruling against a Nigerian bank for opening an account using a customer’s identity without their knowledge and authorisation. The full case file is available here.

According to the case file, the complainant, Mr. Chiebuka Nworah received a $450 payment in March 2021. Instead of his UBA domiciliary account which he had opened with the bank in 2020 however, this payment went to a new domiciliary account that the bank had opened for him without his knowledge or permission. Upon receiving an SMS alert from the bank informing him about his new account and the $450 credited into it, he visited UBA’s head office at Marina, Lagos, demanding an explanation.

The bank’s risible explanation was that it had opened the new account for him so as to comply with the CBN’s ‘Naira 4 Dollar’ scheme which authorised banks to set up domiciliary accounts for customers that did not have them. Seeing as he already had a domiciliary account, this was clearly a nonsensical reason, but the bank refused to refund the money into his existing account or close the fraudulent account, even after he wrote to them with these demands twice.

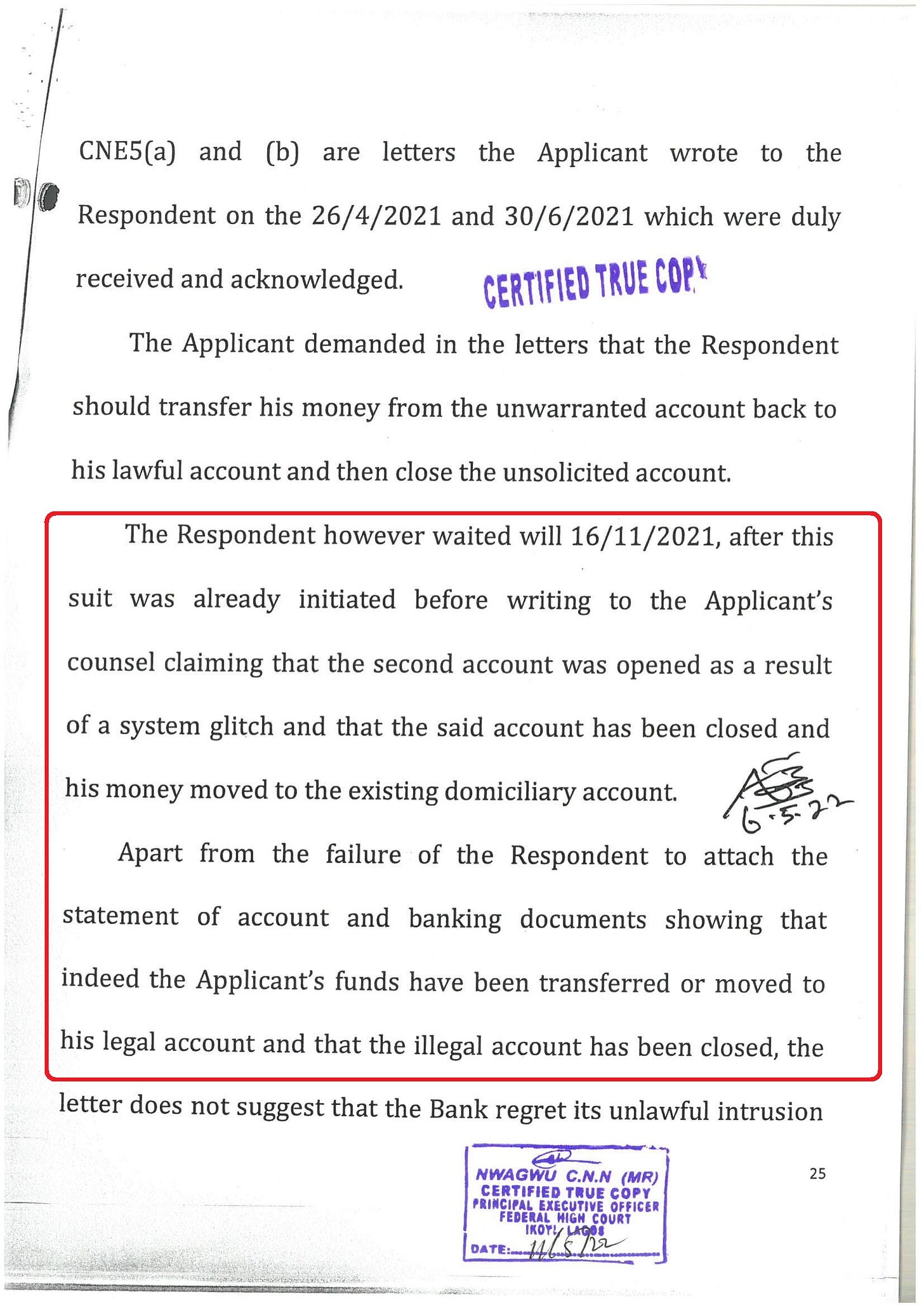

Nworah decided to go to court, and then - coincidentally - UBA immediately sent his lawyer a letter claiming that the new account had been opened due to a “system glitch” and that the $450 had been refunded to his existing account. No bank statement or proof was provided to corroborate the alleged refund.

Delivering his ruling, Justice Aluko said:

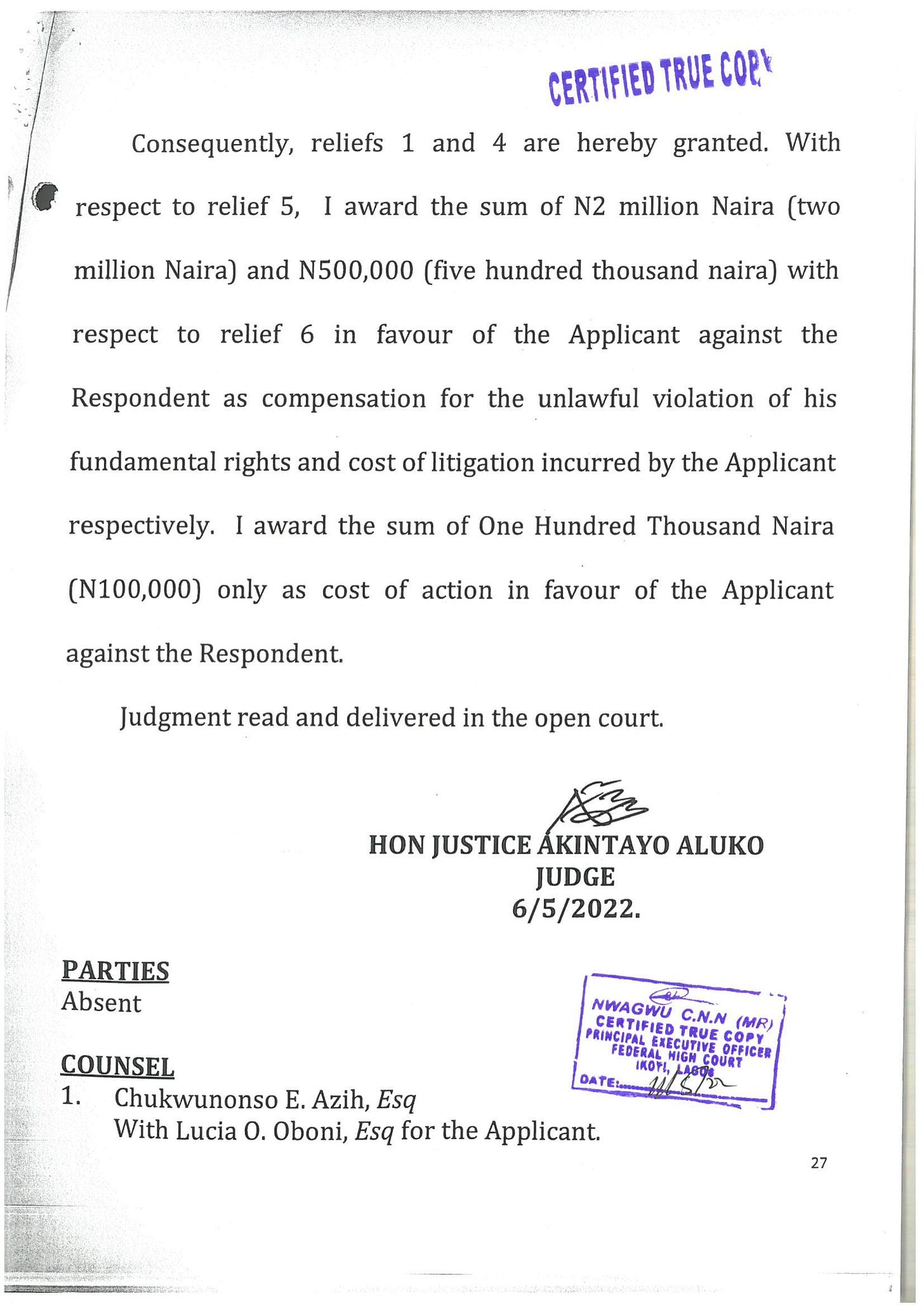

“The content of the letter of the Respondent’s counsel dated 16/11/2021 is a further confirmation establishing the bank’s violation of the applicant’s right to privacy provided in Section 37 of the constitution. I agree with the Applicant that he is entitled to compensation in terms of damages for the Respondent’s wrongful, unjustified, unlawful and unwarranted breach and infraction of his constitutional right to privacy.”

Nworah was awarded N2,500,000 in damages against UBA, which was ordered to pay a further N100,000 in costs.

For Nworah, the story at least had a happy ending. The customer in the next story had no such luck.

Polaris Bank And The Customer Who Can't Get An Account Statement

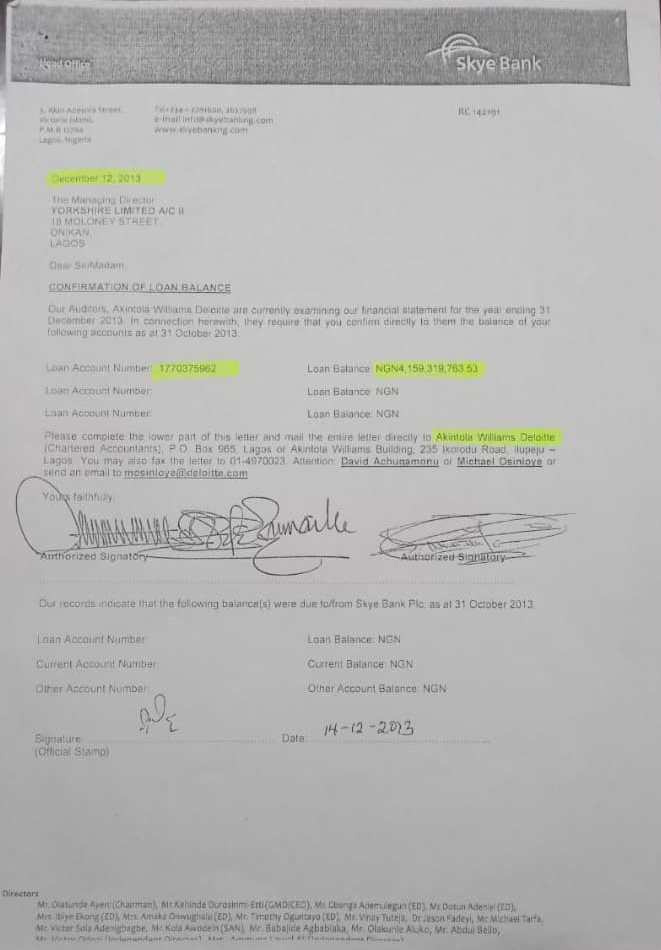

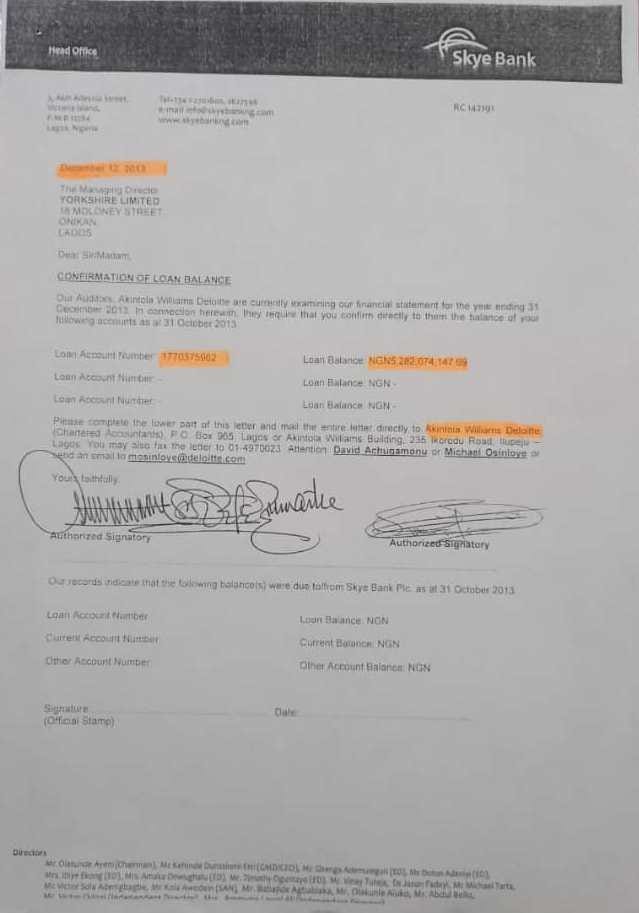

In 2008, Yorkshire Limited, a private company in Lagos took out a loan from Polaris Bank, which was then known as Skye Bank. The initial loan amount remains shrouded in secrecy as I was not able to get hold of the initial loan agreement. All that is known for sure is that it was a 10-figure amount, and all was going well until December 2013 when Skye Bank sent the company a confirmation of its loan balance stating that it was N4,159,319,763.53.

A few hours later on the same day, another confirmation of loan balance came in from Skye Bank with a completely different figure on it. This time, the stated loan balance left to be repaid was N5,262,074,147.09. No explanation was offered for why there was a N1.1 billion disparity.

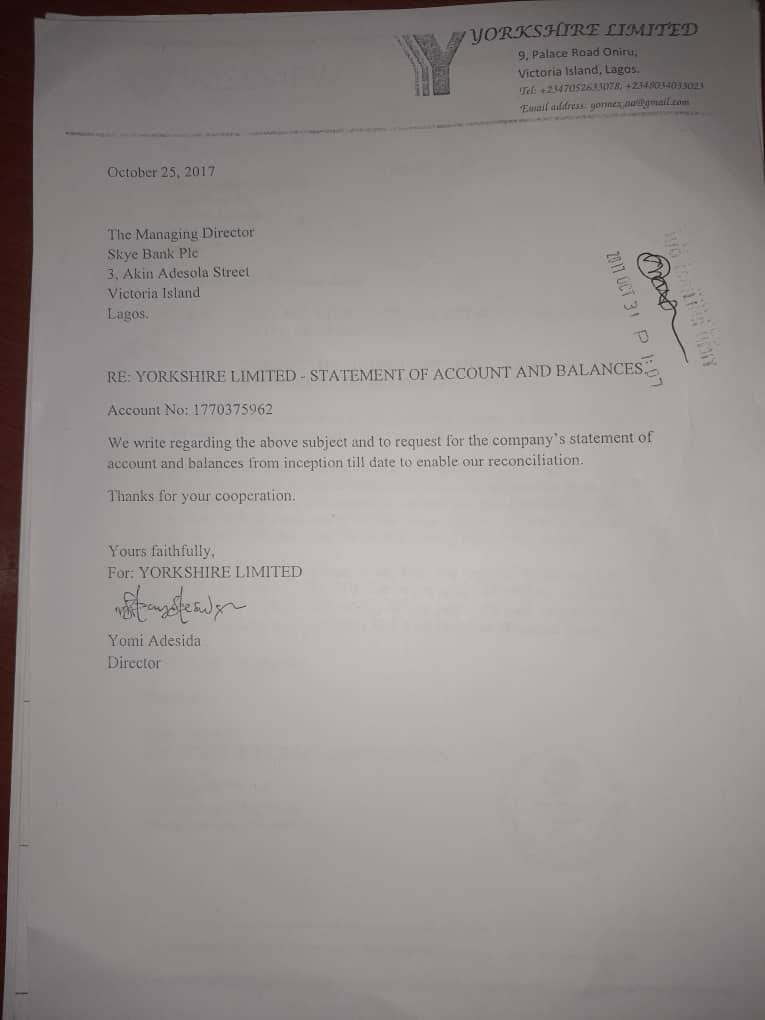

Alarmed by the unprecedented phenomenon of a bank getting its customer’s account balance wrong by over N1.1 billion, the company requested a statement of account from Skye Bank, and this is where the “fun” started. Skye Bank did not provide the statement or give any reason why. Between 2013 and 2017, the company made several attempts to obtain a statement of account from Skye Bank - something that should normally be provided instantly after a single request.

Still, no statement was forthcoming from the bank. In October 2017, the company wrote officially to Skye Bank asking for its statement of account. Once again, Skye Bank ignored the request and offered no explanation.

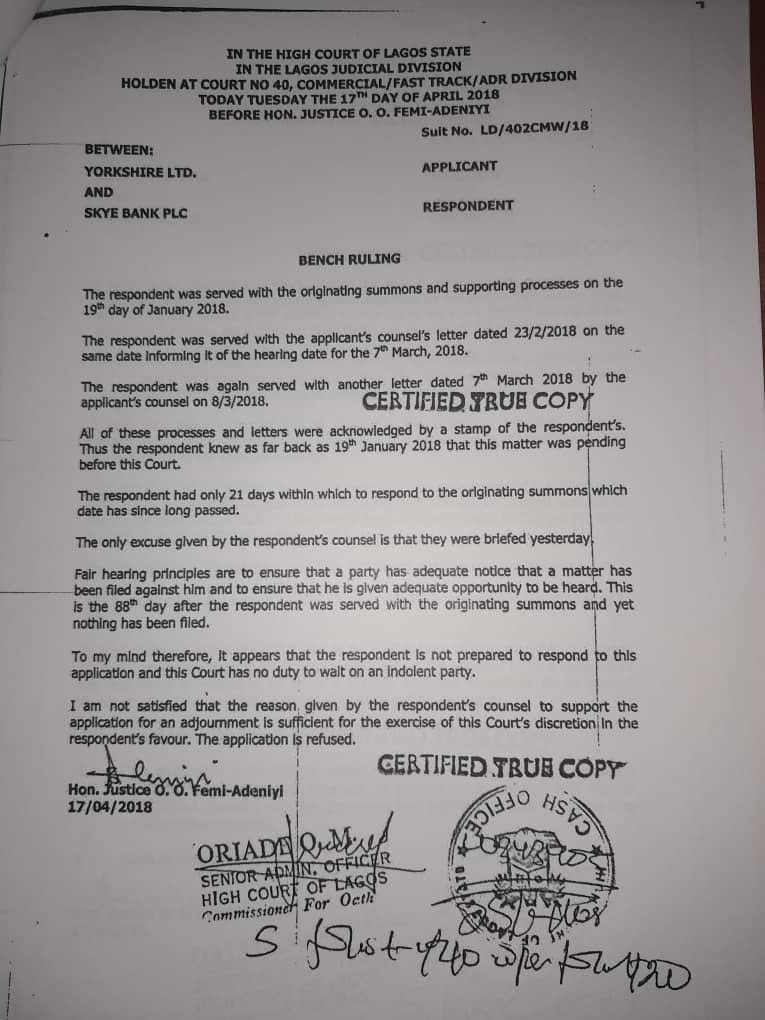

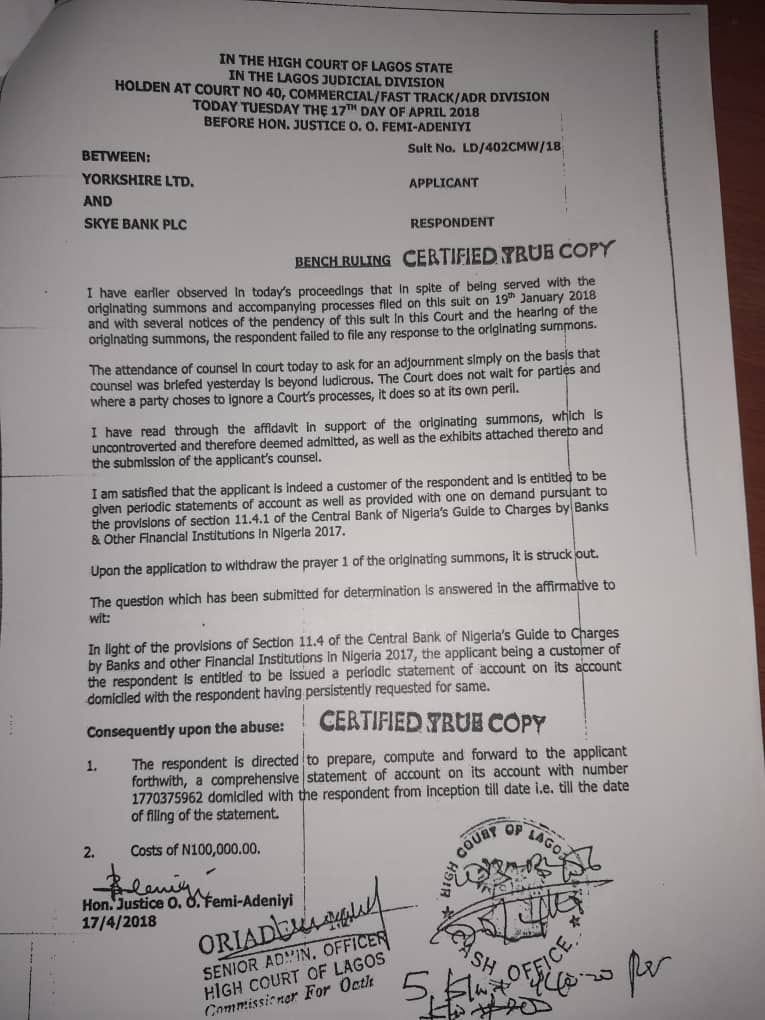

Finally in December 2017, the company went through the legal route, writing the bank through its legal consultants, Wiseview Legal Consultancy to demand for its statement of accounts. Once again, there was radio silence from Skye Bank. Finally Yorkshire Limited went to court, obtaining a ruling from the Federal High Court in Lagos on April 17, 2018 ordering Skye Bank to provide the requested statement of account immediately.

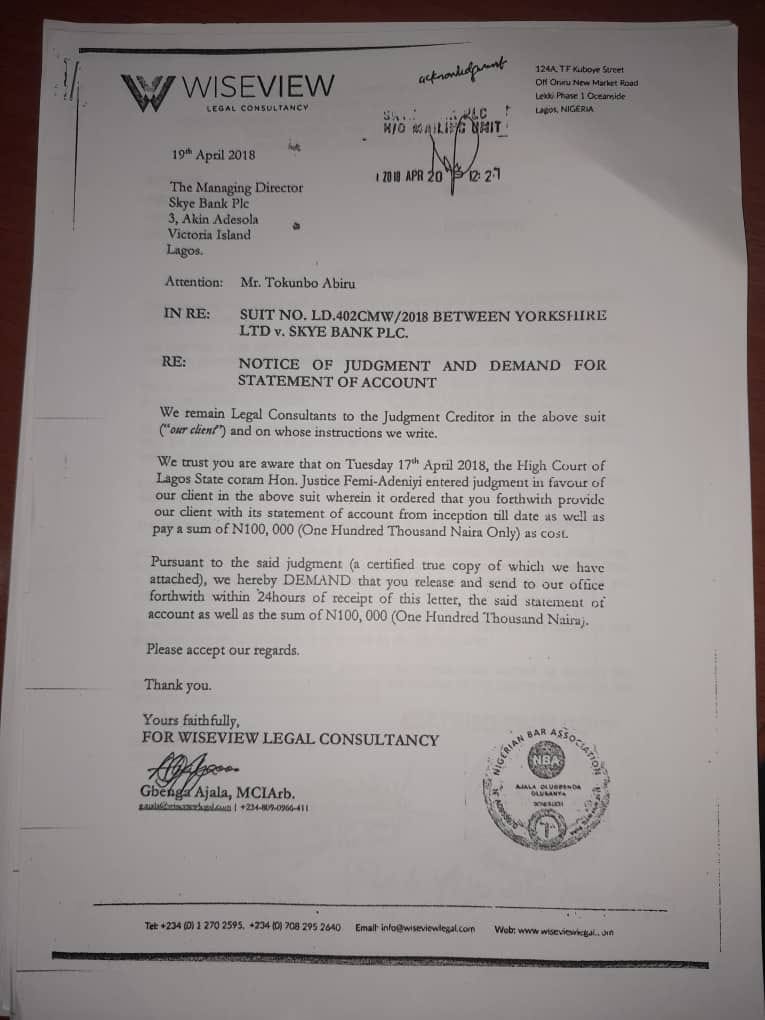

Still Skye Bank refused to produce the requested statement, despite this clearly being a violation of a court order. On April 19, 2 days after the court judgment, the company’s lawyers once again wrote to Skye Bank demanding that the bank comply with the court order and provide a statement of account for Yorkshire Limited. Yet again, Skye Bank responded with - nothing. No statement. No explanation. No conversation. Nothing.

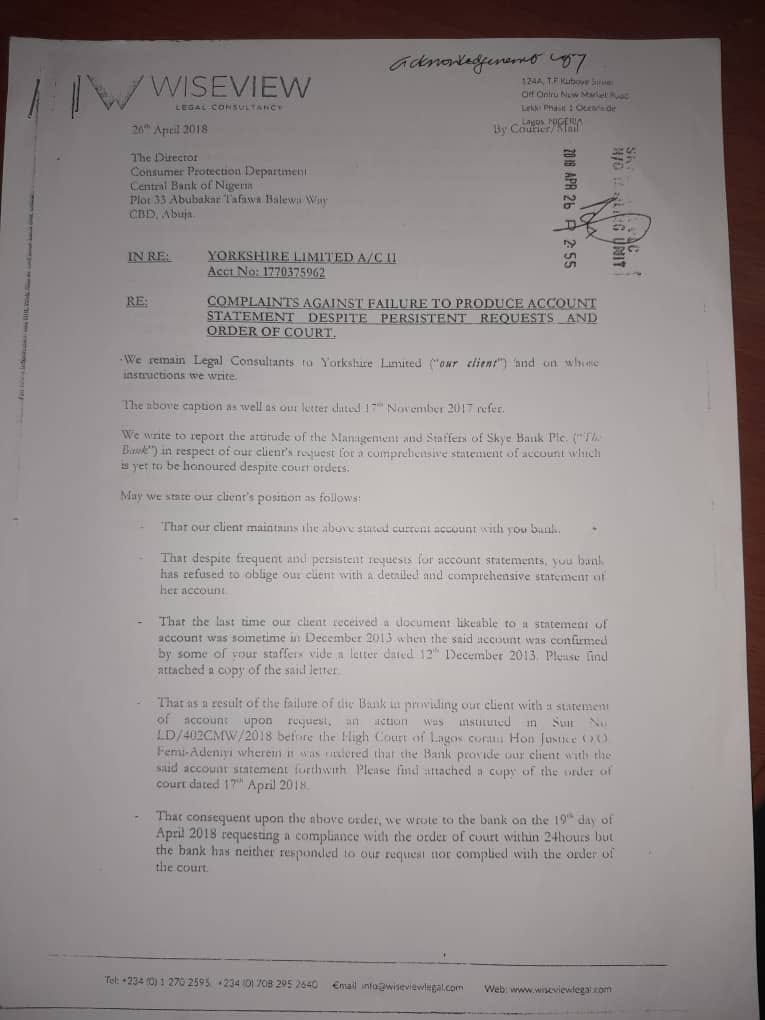

On April 26, 2018, company lawyers once again wrote to Skye Bank demanding for the account statement as ordered by the court. Once again, no prizes for guessing Skye Bank’s response.

Yorkshire Limited also wrote to the CBN without getting any significant response. Out of options, the company decided to go to court a second time to get the prior ruling enforced. Instituted at the Federal High Court in Lagos on April 15, 2019, the suit sought to compel the bank (now Polaris Bank following a CBN takeover) to comply with the prior court order and produce the statement of accounts which it had been hiding since 2013.

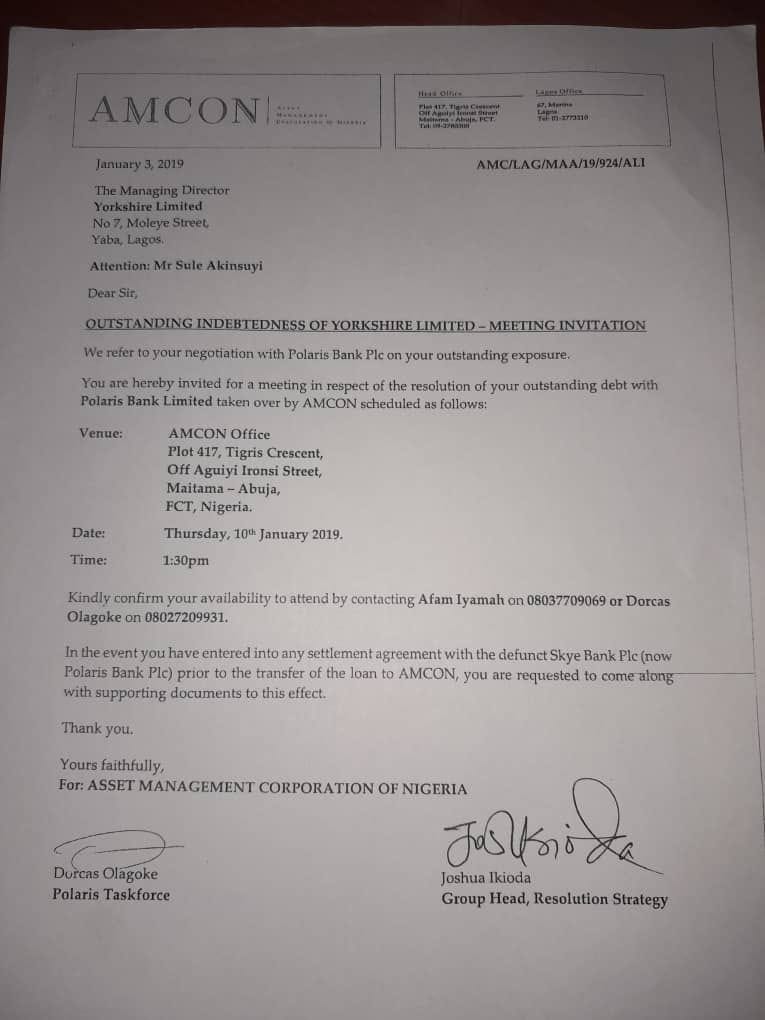

At this time, following Skye Bank’s transformation into Polaris Bank, the Asset Management Corporation Of Nigeria (AMCON) had taken over the bank’s liabilities and assets, including its loan portfolio. Somewhere on this loan portfolio was Yorkshire Limited’s mystery loan without an account statement. In January 2019, AMCON wrote to Yorkshire informing the company that it now owned the loan. No loan balance was stated in the letter.

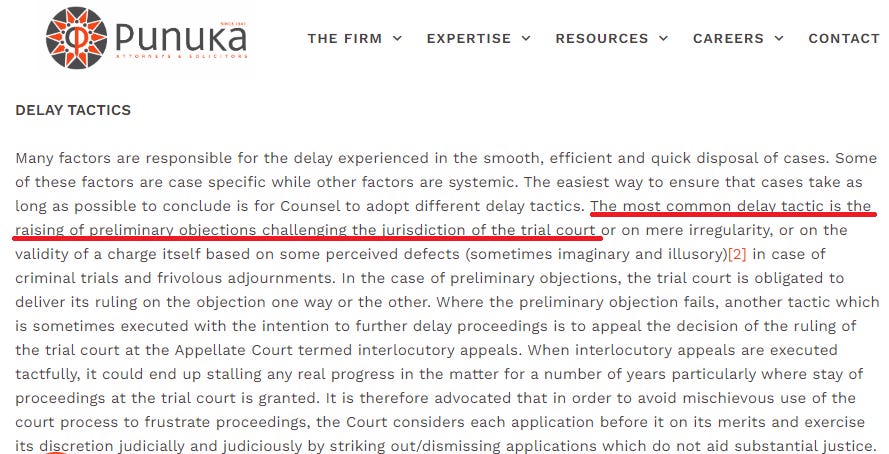

With Yorkshire’s case in the Federal High Court pending and heading toward another loss for Polaris Bank, a bit of “magic” suddenly took place. First in March 2020, AMCON and Polaris Bank instituted a joint motion to dispute the jurisdiction of the Court to hear the case. This infamous “technical justice” tactic is one that typically characterises Nigerian court cases and keeps cases going indefinitely.

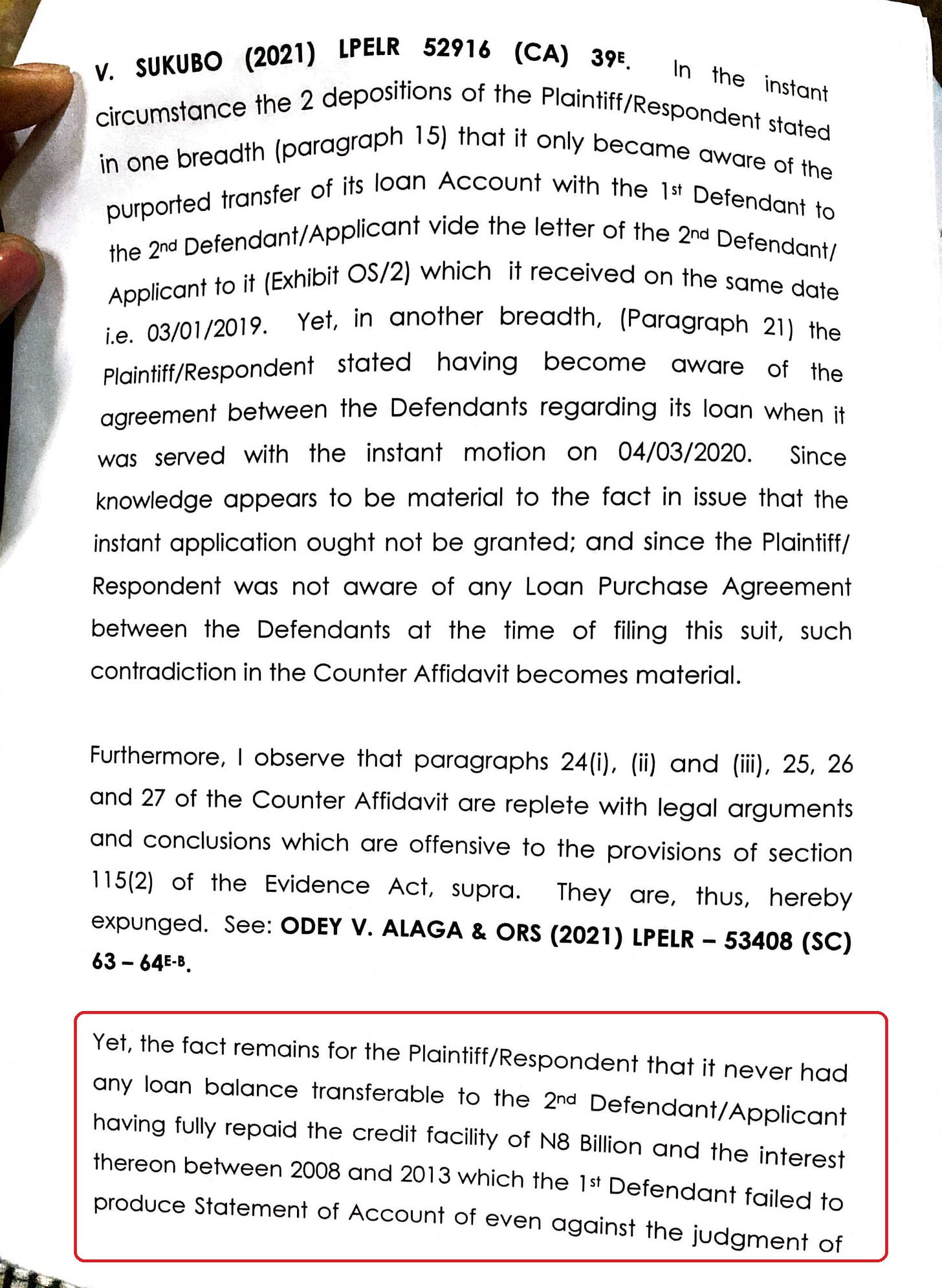

This objection was apparently based on an amendment to the AMCON Act. The ruling by Justice T.G. Ringim which can be found here, makes for interesting reading. In the ruling, Justice Ringim ultimately agreed with the objection challenging the court’s jurisdiction, but he also confirmed that neither Polaris Bank nor AMCON had in fact, been able to substantiate their claim of Yorkshire’s indebtedness by providing any documentation to confirm the debt and its amount.

Justice Ringim did appear to contradict himself in the same ruling. According to him, AMCON’s purchase of Yorkshire’s mystery loan with Skye/Polaris Bank in 2018, as stated by AMCON was also enough fact to suggest that Yorkshire is indeed indebted to Polaris Bank - even though nobody knows how much, including apparently AMCON and Polaris Bank itself.

Yorkshire subsequently filed an appeal against the ruling, and the case remains in court. Why exactly was it so important to AMCON and Polaris Bank that Yorkshire Limited must not have access to its statement of account to find out exactly how much - if anything - it owed? What happened next provides a clue.

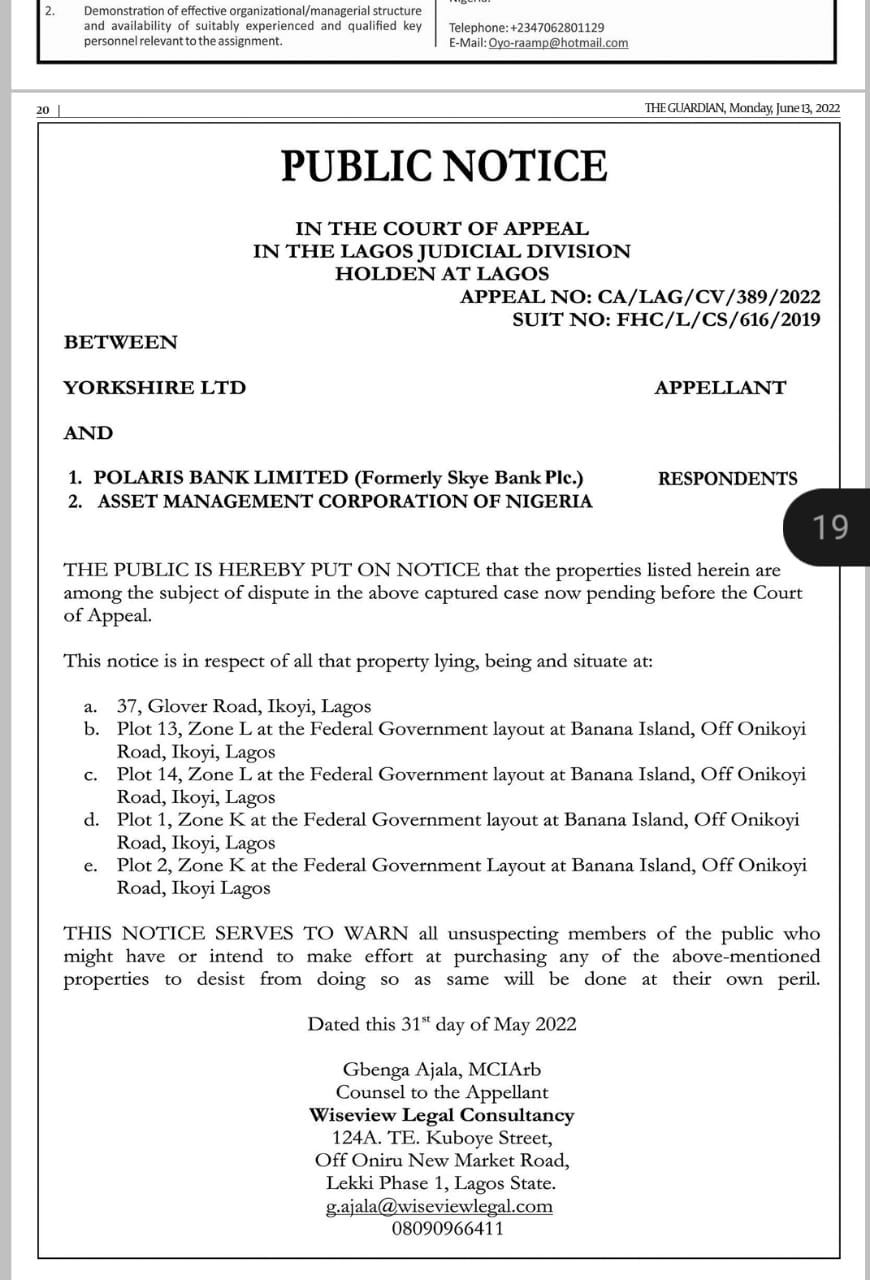

With the case still in court, AMCON suddenly began making rapid moves to sell 5 properties in Ikoyi, Lagos, which were used as collateral for the initial loan. Bear in mind that the very loan balance in question had remained shrouded in secrecy since 2013. Somehow, despite not knowing how much the loan balance was, AMCON knew how much was needed from the sale of 5 high-value properties to liquidate it.

This forced the company to immediately take out a “Caveat Emptor” advertorial in The Guardian newspaper of Monday, June 13, 2022, warning any prospective buyers that the properties are subject to an ongoing legal process.

So here we have a poorly run bank that offered multiple balance figures on the same account with a variance of N1.1 billion in 2013, and then spent the subsequent 9 years refusing to issue a statement of account so that the customer might confirm how much they actually owed. Having been dragged to court twice to issue the statement of account, the bank and AMCON - a government body - then teamed up to sabotage a legal process aimed at getting the bank to issue the customer a statement of account. AMCON then went into ‘omonile’ mode, trying to sell expensive properties used as collateral by the borrower with the case still in court.

The final icing on the cake? On August 2, 2022, Peoples Gazette reported that the CBN had received presidential permission to sell Polaris Bank to Auwal Gombe, a relative of former military dictator Ibrahim Babangida for a knockdown price of N40 billion, following AMCON’s N1.2 trillion rescue of the lender in 2018.

Has Yorkshire Limited been the victim of a long-standing play to help politically linked businessmen to gobble up valuable assets (such as Banana Island property) on the cheap by using a bank to basically steal them from their owners?

Only the courts will decide that now.

Hopefully.

Access Bank And The MBA Forex Inside Story

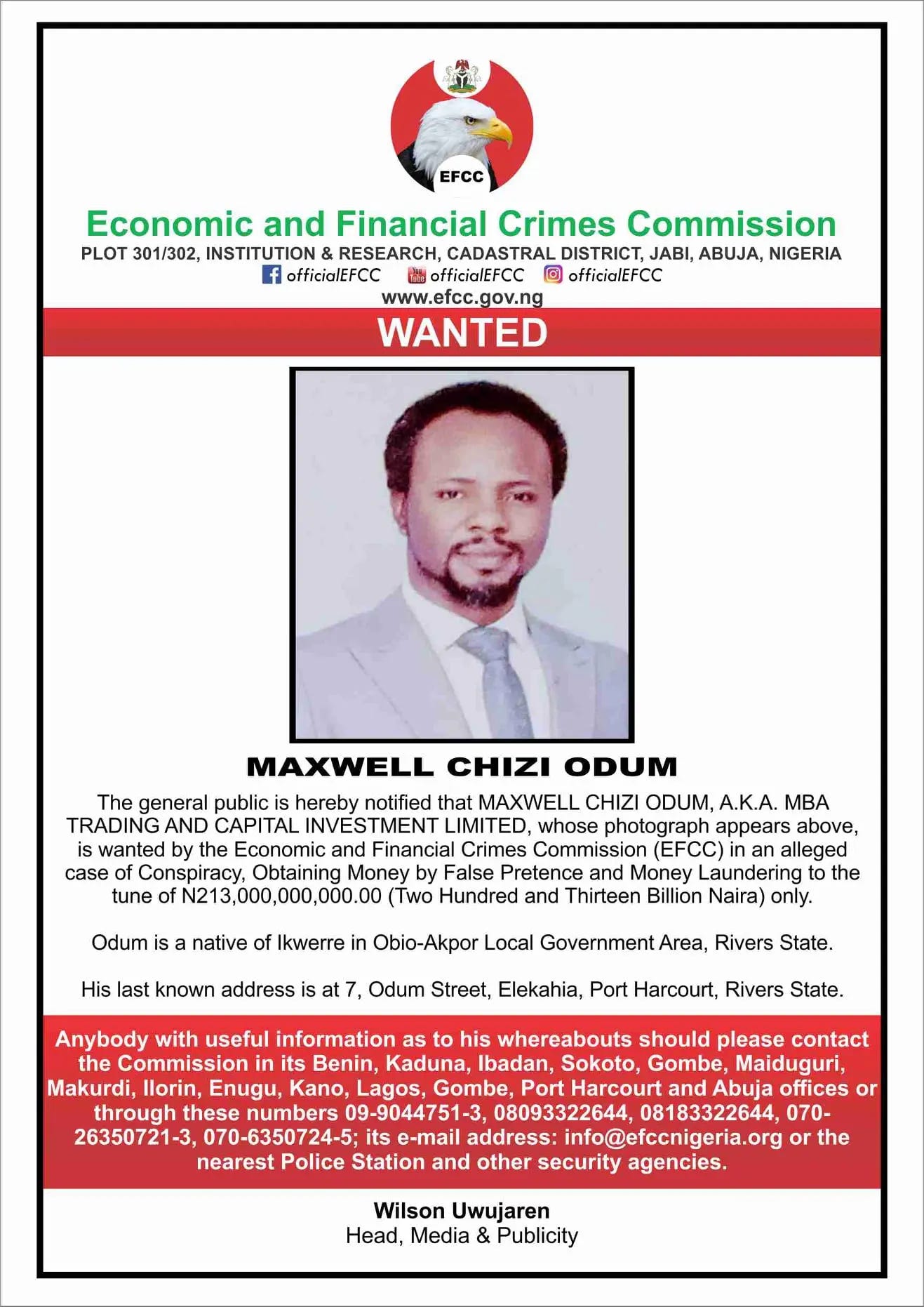

These days, Maxwell Chizi Odum is known as the criminal mastermind behind one of the biggest ponzi schemes ever conceived in Africa. He has been declared wanted by Nigeria’s Economic and Financial Crimes Commission (EFCC) and his whereabouts have been unknown since 2021. Once a respected pastor and mentor, he now lives as a fugitive, albeit a rich one, possibly with a second passport and a new identity.

Things used to be very different for ‘Brother Maxwell.’ Following a fairly nondescript corporate career in the oil servicing industry, he came to prominence as a widely liked and admired pastor at the popular Believers’ Loveworld (Christ Embassy) church in Port Harcourt. It was here that he would lay the groundwork for what would become a N213bn heist.

As in so often the case in Nigeria, not many people bothered to ask how a Pentecostal pastor with no significant background in finance or investment supposedly figured out an investment secret guaranteed to make them fabulously wealthy. All they saw was that other people paid money into this thing known on the street as MBA Forex, and they came out with amazing double digit returns via an investment system that was far too complicated for anyone to really understand, even if they wanted to.

Something, something…trading strategy, something…binary forex options, something, something…cryptocurrency volatility. And then something about a matrix-based trading system, which you know, absolutely, definitely, positively was not a ponzi scheme like MMM.

Naturally, it was of course, a ponzi scheme, pretty much exactly like MMM.

Under Nigerian law, the act of soliciting for and receiving monetary deposits from the public constitutes an act of carrying on banking business which requires a banking licence from the CBN. Further, the commercial offer of any investments that promise fixed interest amounts when funds are invested for fixed periods of time is a strictly regulated activity that falls squarely under the oversight of the Securities and Exchange Commission (SEC).

MBA Forex was doing both of these regulated activities despite having no kind of regulatory approval or permission whatsoever. In fact, beyond registration with the Corporate Affairs Commission (CAC) - which pretty much anything with a pulse and a valid ID can do without any kind of regulatory spotlight - MBA Forex was an entirely illegal operation.

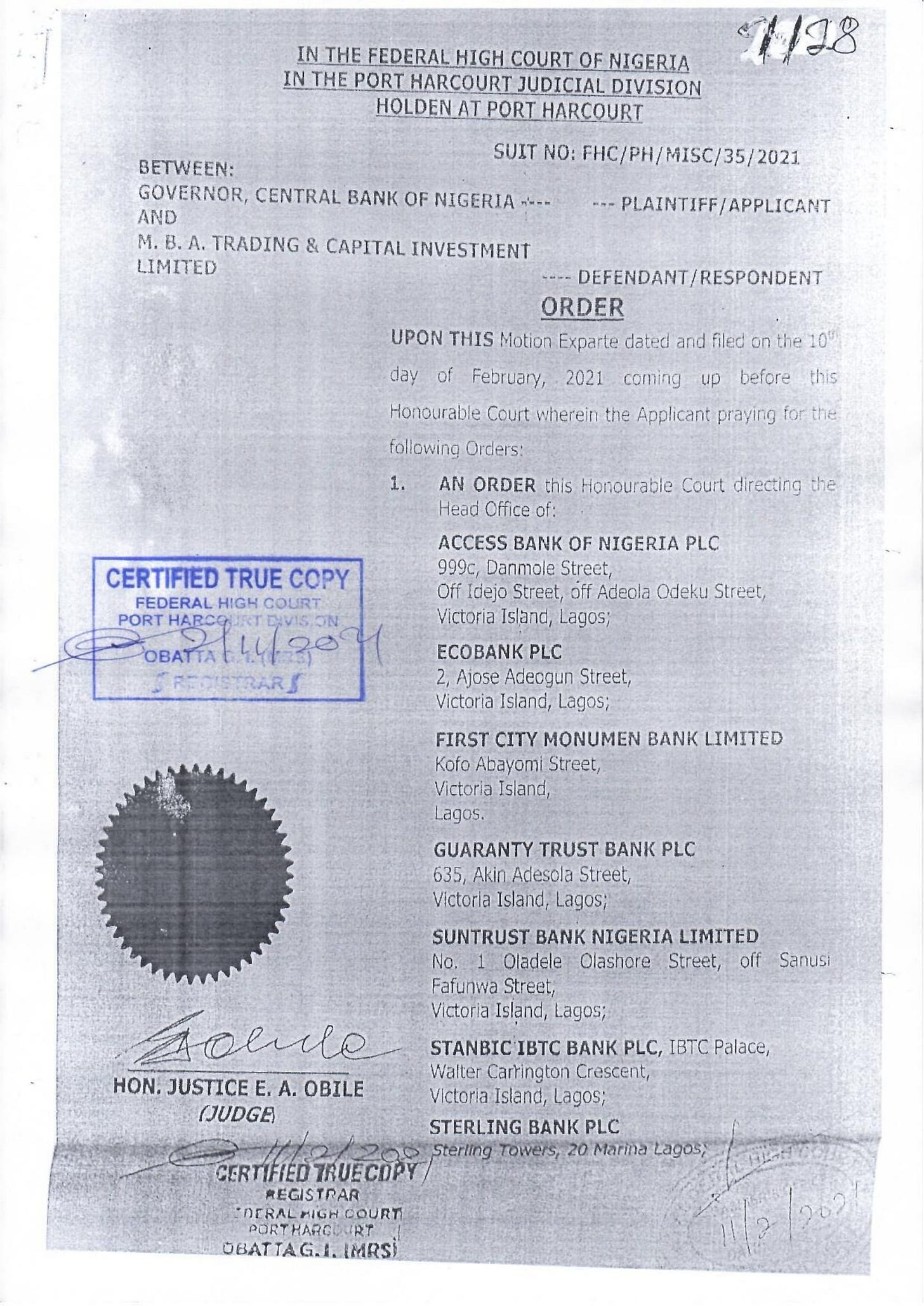

The difference between MBA Forex and MMM was that while MMM tried to obfuscate its centralised nature by using individual bank accounts, MBA Forex openly accepted funds into the corporate accounts it was somehow able to open at Access Bank, Ecobank, FCMB, First Bank, GT Bank, Sterling Bank, Sun Trust Bank, UBA, Unity Bank, Union Bank and Zenith Bank - despite having exactly zero CBN and SEC authorisation. This is where the story gets interesting.

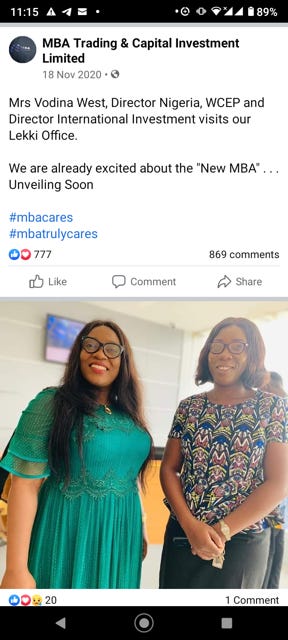

Enter a company called World Citizen Equity Partners Limited. This company, purportedly a British company that organises citizenship-by-investment for wealthy people, was registered in Nigeria on March 21, 2018, a few days after MBA Forex was registered on March 14, 2018. WCEP would later claim that it had nothing to do with MBA Forex prior to December 2020, but the screenshot below contradicts this. Keep this in mind because it becomes important later.

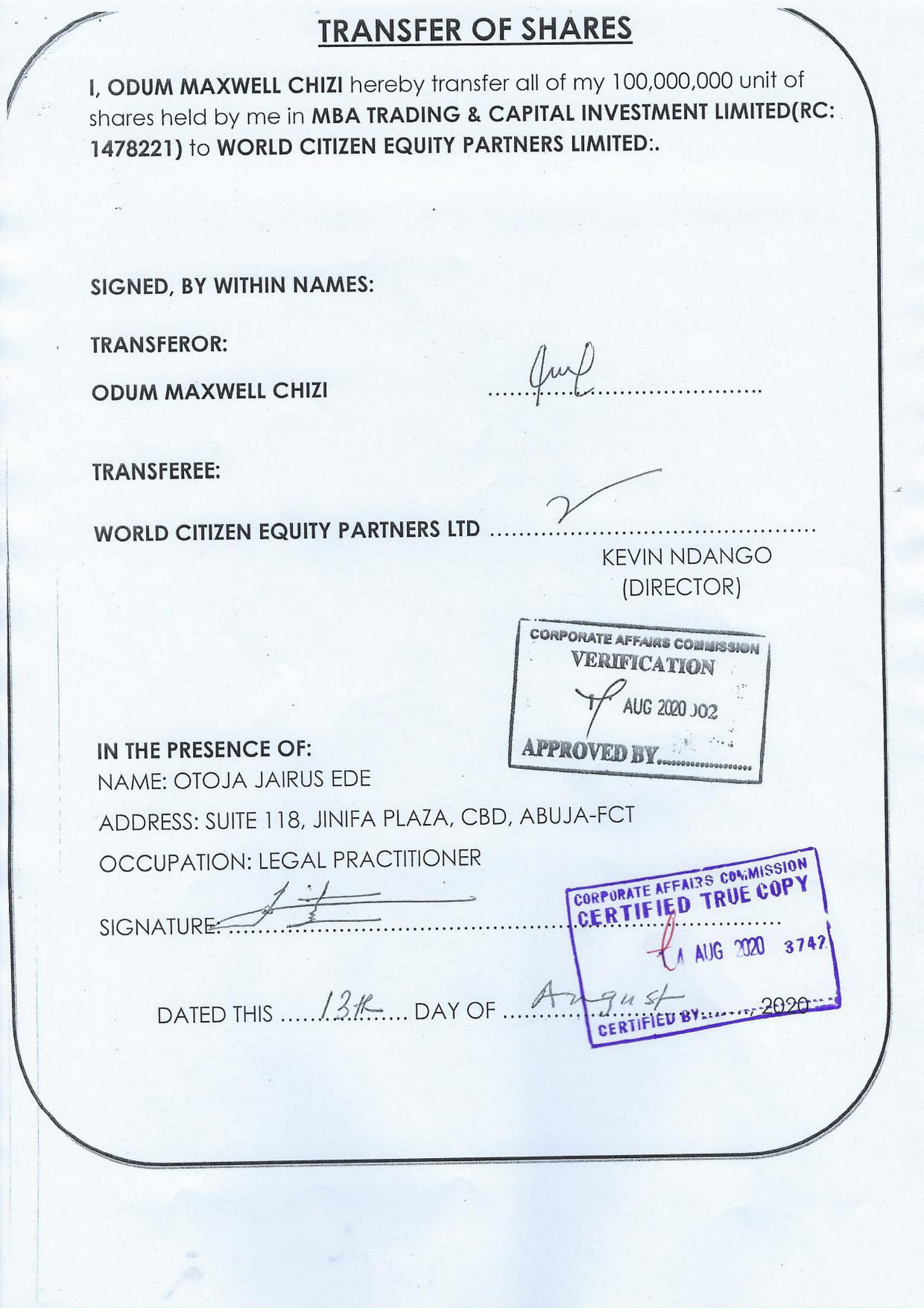

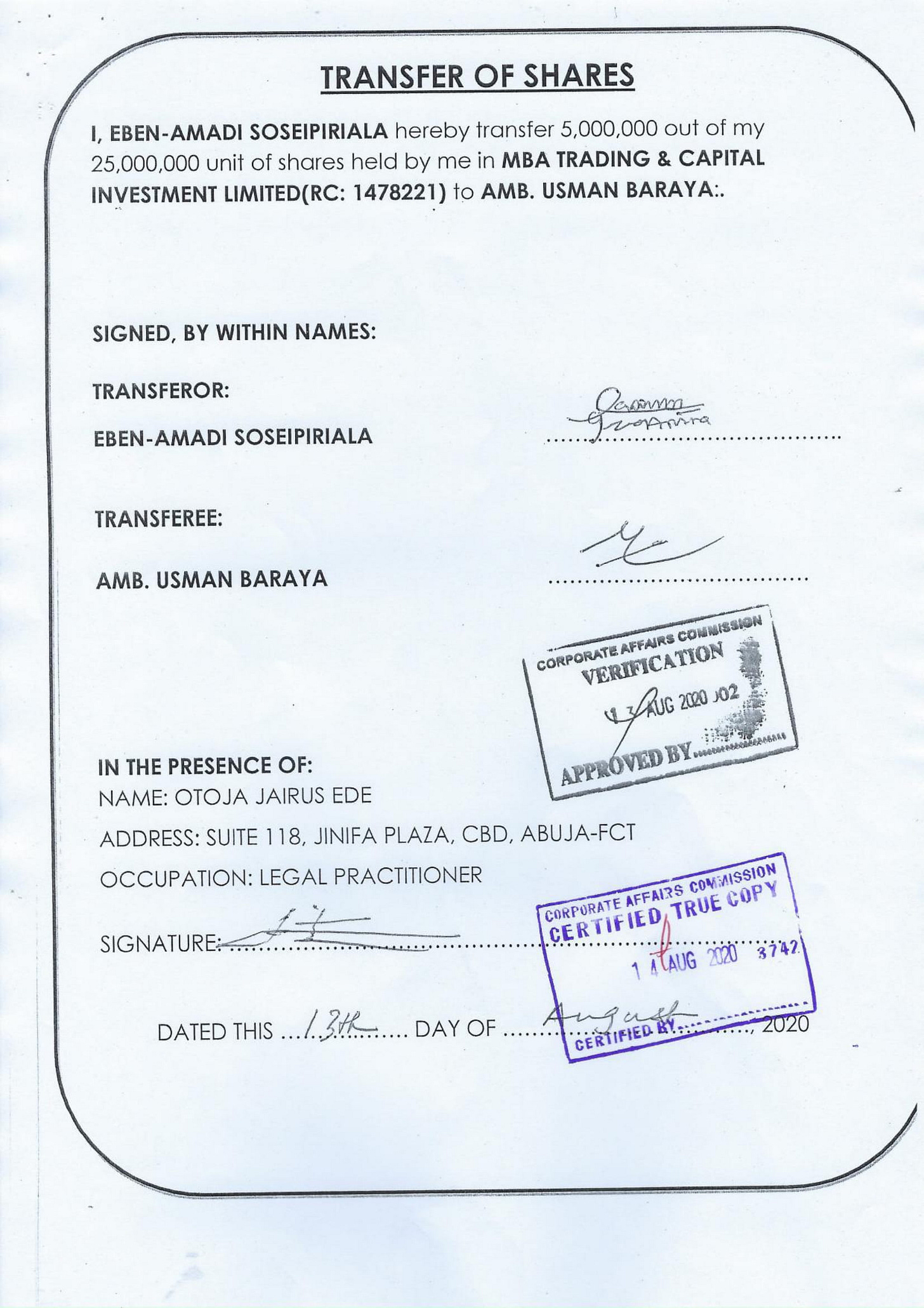

In August 2020, Maxwell Odum transferred 100 million of his shares in MBA Forex to WCEP, in a transaction that saw some familiar names take up investment positions in the ponzi scheme.

The two gentlemen mentioned in the documents above are a former House of Representatives member and a former Nigerian Ambassador to the European Union (EU) and African Union (AU) respectively. Exactly why Hon. Ahmed Aliyu Wadada and Ambassador Usman Baraya decided to buy shares in a ponzi scheme remains unclear.

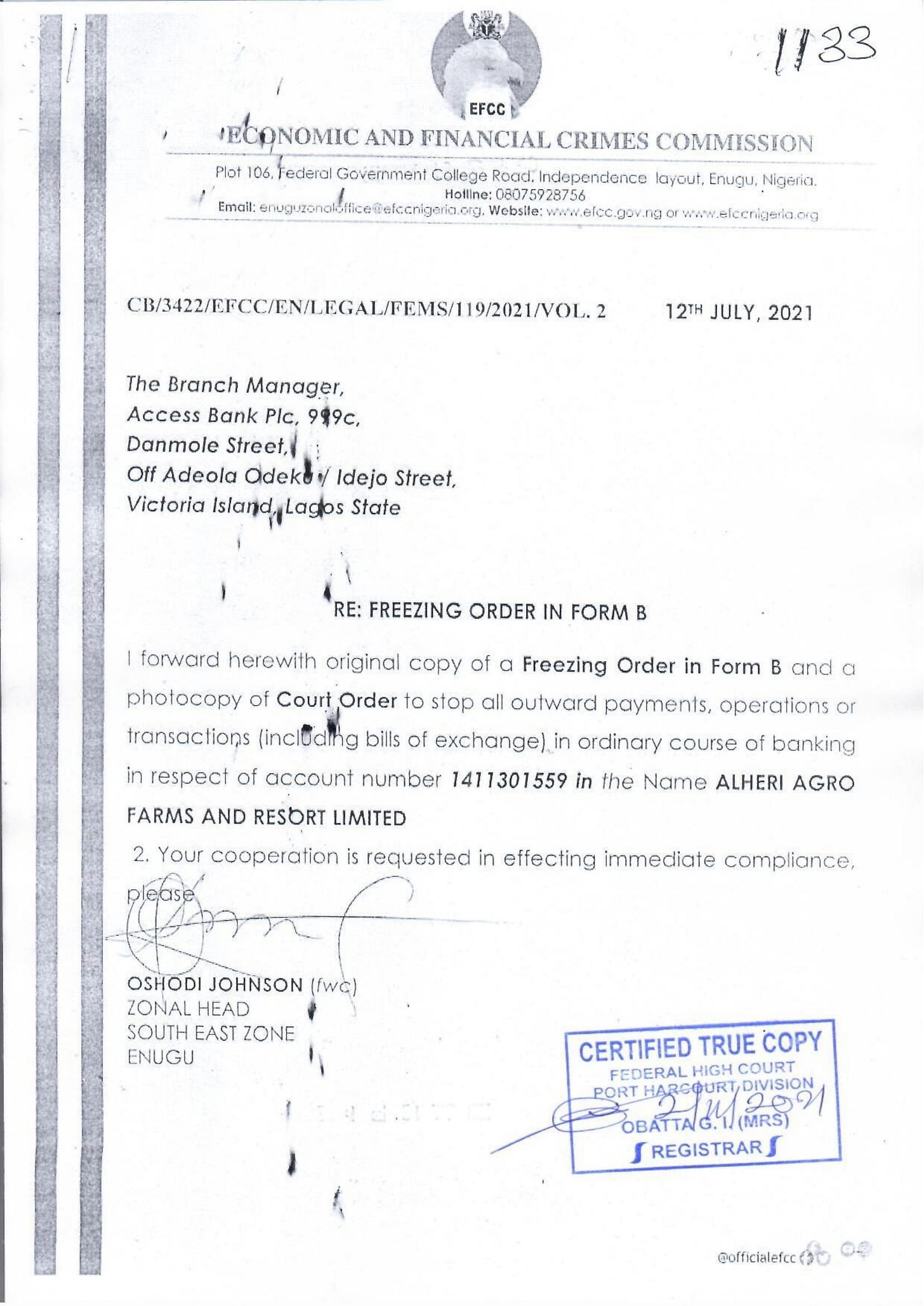

In December 2020, MBA Forex met the inevitable fate of all ponzi schemes, and thousands of Nigerians were thrown into mourning as their dreams of making it rich went up in smoke. Over the next few weeks and months, court orders and regulatory actions began rolling in to freeze accounts and potentially reimburse investors. Access Bank, which had hosted the majority of funds harvested by MBA Forex and Maxwell Odum, was front and centre of the investigation.

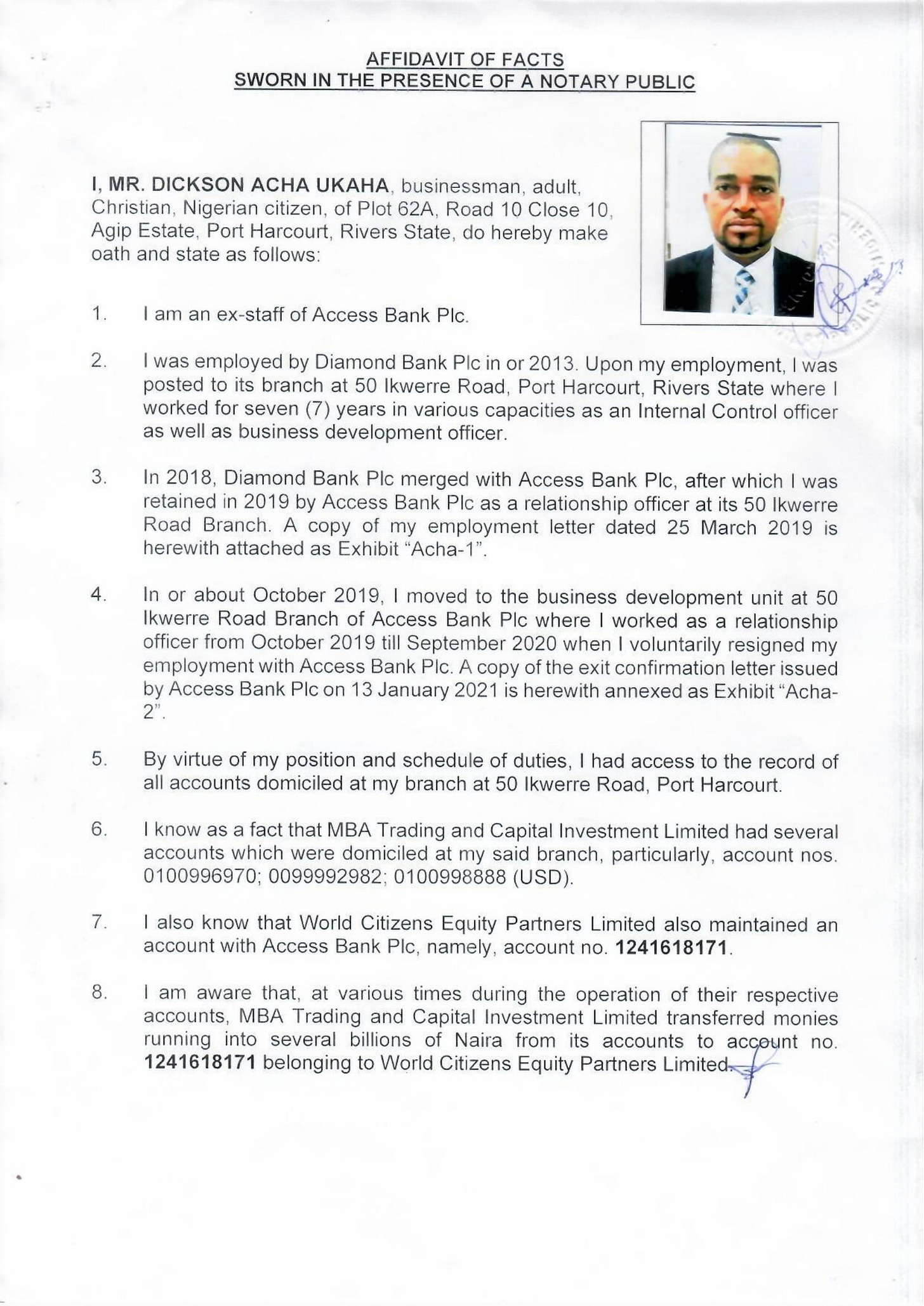

The bank however, decided to conceal the true role it played in aiding and abetting the ponzi scheme. In a sworn statement provided through its lawyer, the bank claimed that it had closed all the offending accounts as soon as it was told to, and that in any case, the main MBA Forex account had just a little over N200,000 left inside it. In an effort to hide the central role it played in enabling Maxwell Odum to get away with the scam, Access Bank also lied under oath, stating that World Citizen Equity Partners (Respondent 10) never had an account with the bank.

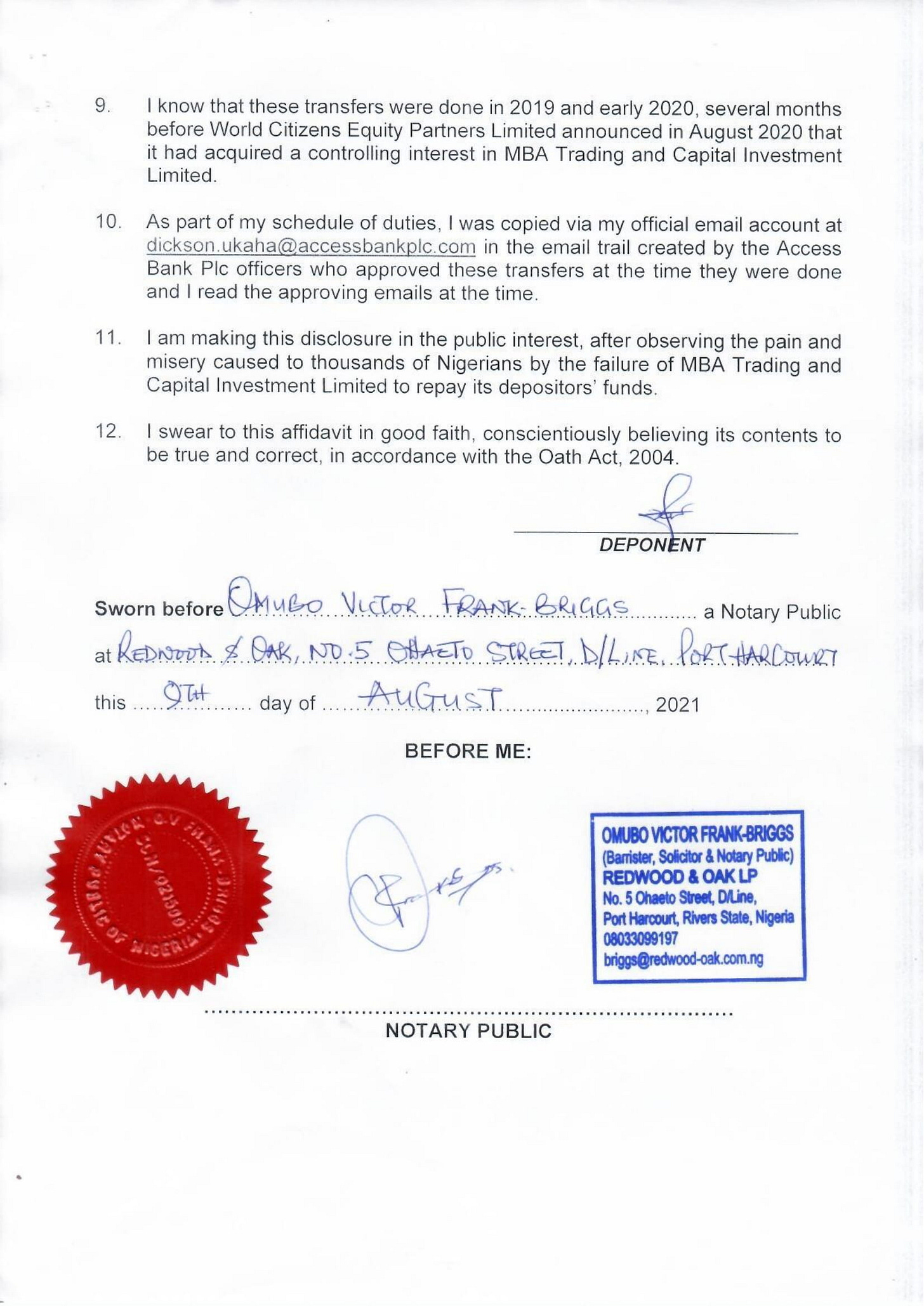

An affidavit sworn by Dickson Ukaha, a former Access Bank customer relationship manager in Port Harcourt directly contradicted this account of events. In his sworn statement, Ukaha stated that not only did WCEP maintain an account with Access Bank, but several transfers worth hundreds of million of naira - the sort that normally raise every AML red flag in the bank - were made from the MBA Forex account to the WCEP account months before the purported sale by Maxwell Odum.

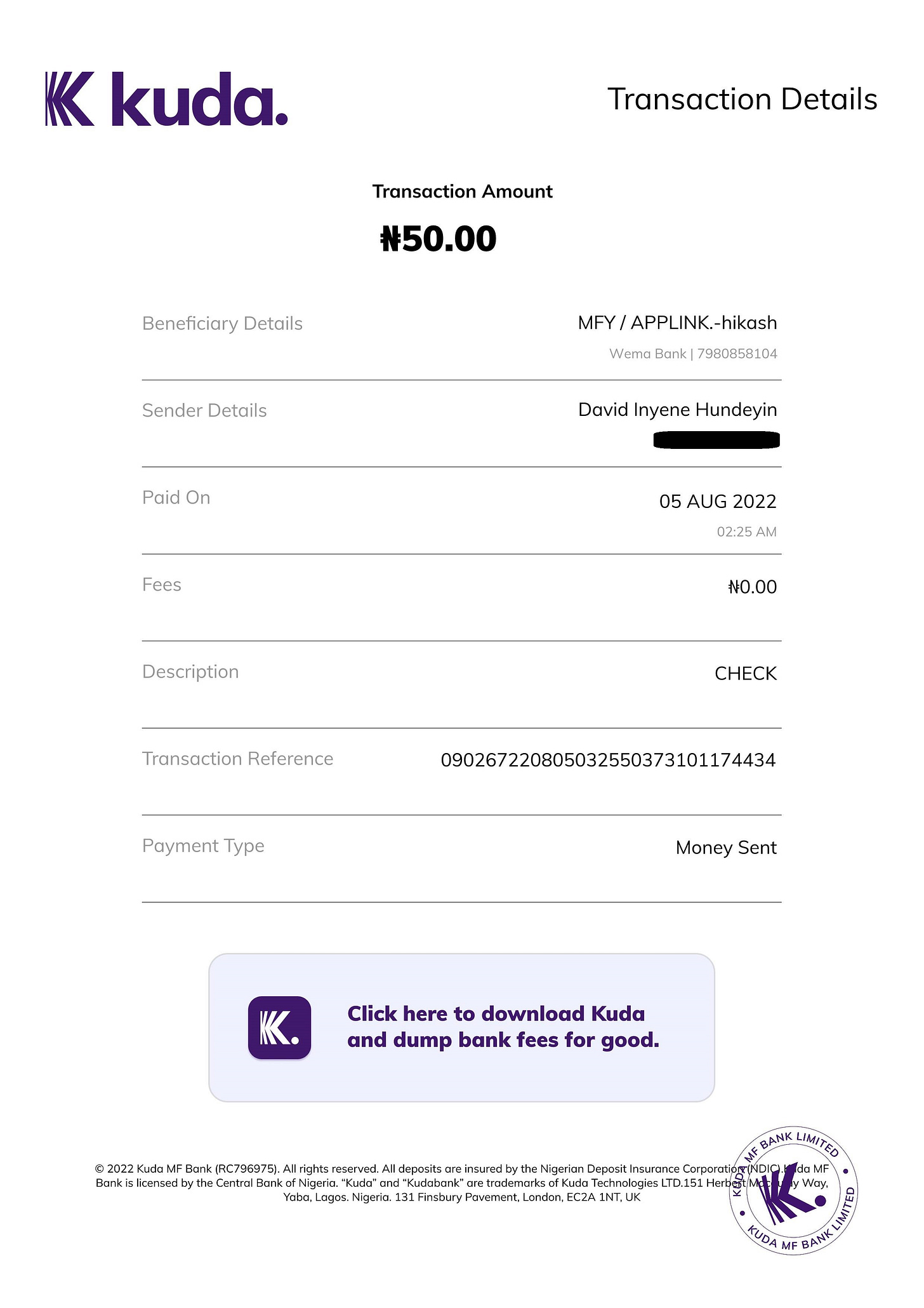

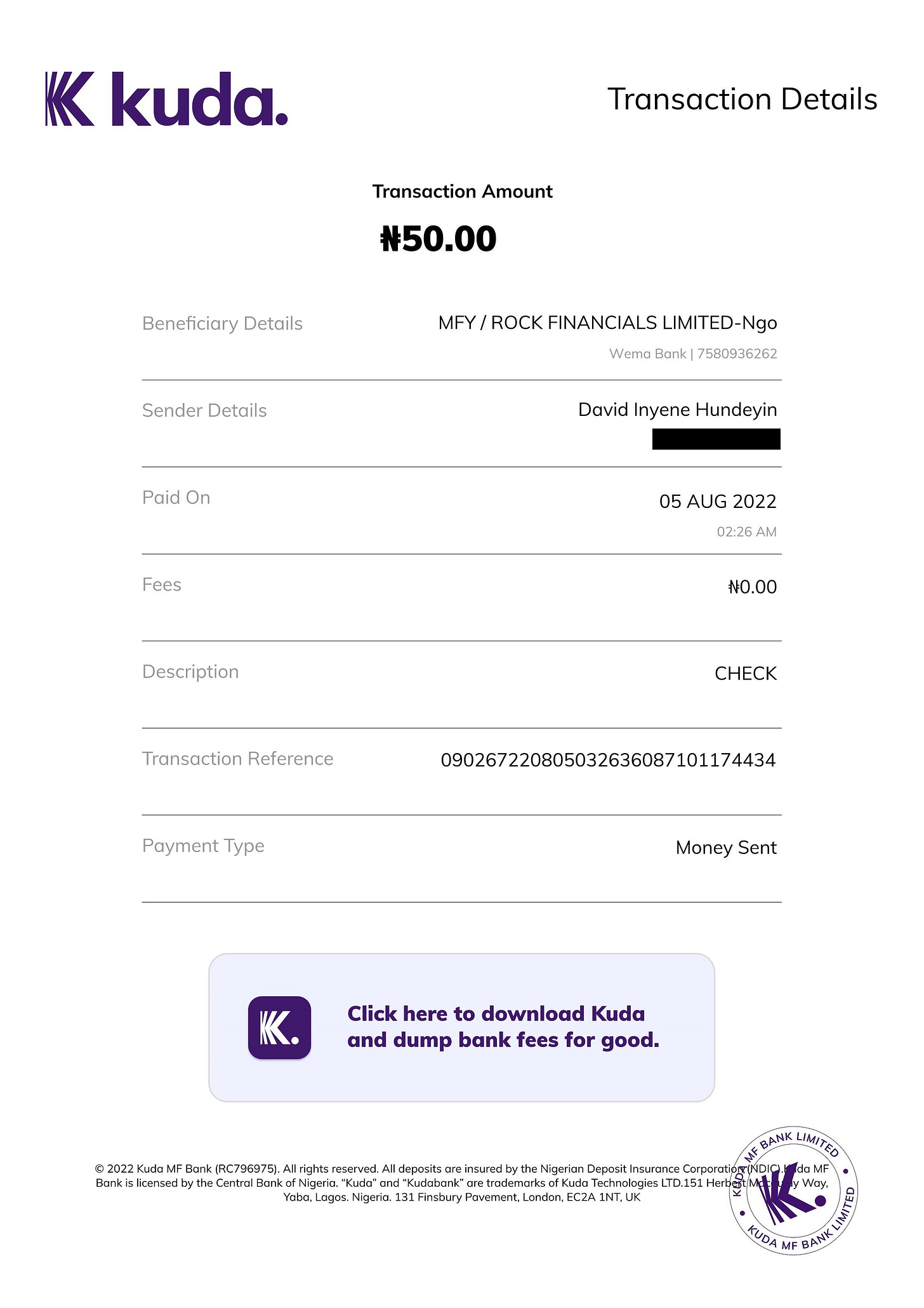

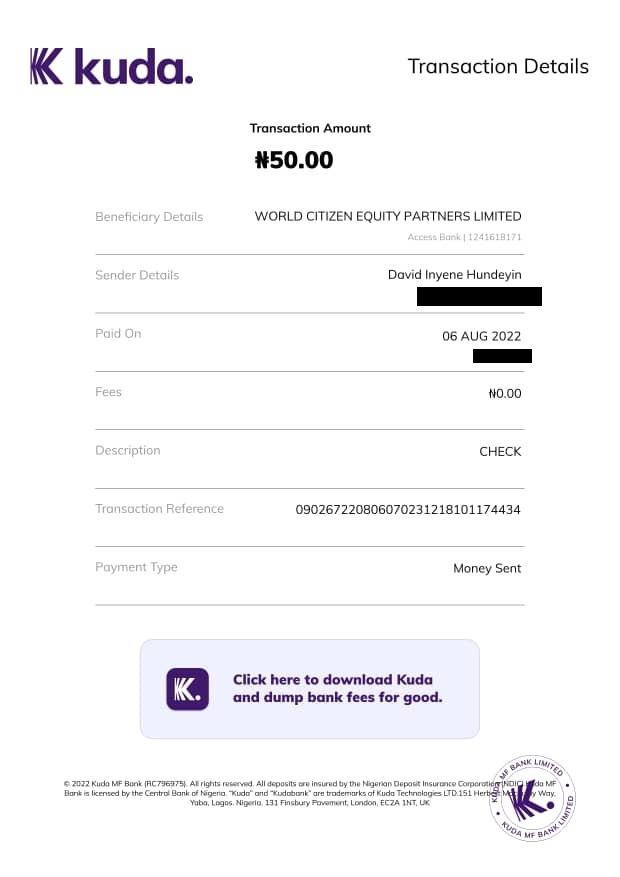

So here we have a bank that knowingly enabled an illegal investment scheme without CBN or SEC licenses to fleece customers of billions of naira, and then lied under oath afterward to cover up the extent of its involvement in the MBA Forex fiasco. My source informed me that not only did Access Bank lie about not maintaining a WCEP account, but the account is very much active. Just to be sure, I asked for the account details and did a little test transaction to see if it would check out. And sure enough…

Enough said, I think.

Terror Financing And A Shadowy Charity From Qatar

“Abd Al-Rahman al-Nu’aym or Abderrahman Al Nuaimi is a Qatari human rights advocate and co-founder of the Alkarama human rights NGO. He previously taught Islamic Studies at Qatar University, and once served as President of the Qatar Football Association, as well as having been a board member of Qatar Islamic Bank.”

Or that’s what it says on the first 2 lines of his Wikipedia page anyway.

The next line continues, “He has been accused of being “one of the world’s most prolific terrorist financiers.”

“Accused” is one way to put it.

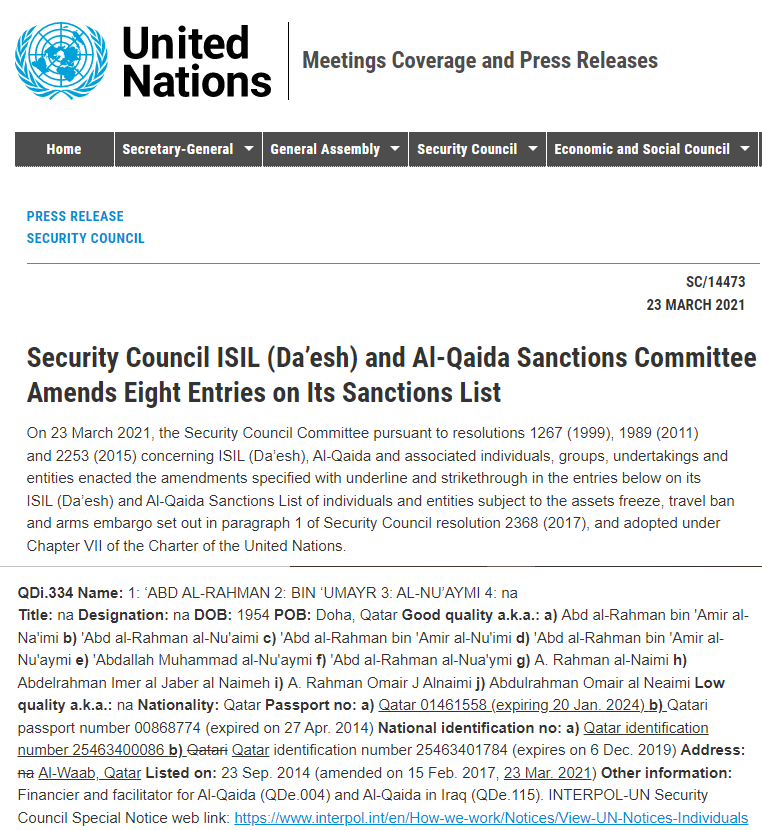

A 2016 sanctions summary issued by the UN Security Council provides more context about exactly what this guy is about. The statement reads in part:

“In 2013, 'Abd al-Rahman bin 'Umayr al-Nu'aymi ordered the transfer of nearly $600,000 to Al-Qaida (QDe.004) via an Al-Qaida representative in Syria, Abu-Khalid al Suri (deceased), and intended to transfer nearly $50,000 more. Al-Nu'aymi has facilitated significant financial support to Al-Qaida in Iraq (AQI) (QDe.115), and served as an interlocutor between AQI leaders and Qatar-based donors. Al-Nu'aymi reportedly oversaw the transfer of over $2 million per month to AQI for a period of time. In mid-2012, Al-Nu’aymi provided approximately $250.000 for distribution to Harakaat al-Shabaab al-Mujahidiin leaders Hassan Dahir Aweys and Mukhtar Robow, and intended to provide additional funding.”

Al Nuaimi has been designated a Global Terrorist by the US Treasury Department for extensively funding Al-Qaida activities in Syria, Iraq, and he is also linked to terror financing as far afield as Egypt and Somalia.

He is on a global sanctions list reserved for the most dangerous global terrorists, subjecting him to an assets freeze, travel ban and arms embargo under Chapter 7 of the UN Charter.

He has even been banned from doing business in the UK or having dealings with any bank with a UK office. You know someone is bad news when even the City of London, which has financial dealings with Russian oligarchs and African kleptocrats, is prohibited from touching that person.

As much as he sounds like bad news, he also seems far away from a West African audience reading this story. That is, until one realises that West Africa is squarely in his sights as well. Al Nuaimi apparently does not content himself with financing terror in the Arab world or the extremities of Africa. His fingerprints, it turns out, are all over Nigeria as well. Here’s how we know.

In early 2022, the Middle East Forum, a US think tank based in Philadelphia got hold of several gigabytes of secret data taken from a prominent Qatari charity. This data showed hundreds of millions of dollars worth of financial outflows to shadowy organisations linked to Wahabbi Islam around the world over a period of up to 2 decades. More on that later, but first a brief explainer about the charity in question.

The charity is called the ‘Sheikh Eid Bin Mohammad Al Thani Charitable Association,’ or alternatively, just ‘Eid Charity.’ Its founder is none other than Abderrahman Al Nuaimi, and the organisation itself is member of the ‘Union of Good,’ an Islamic charity coalition which was designated a terror financier by the US Treasury Department in 2008.

Its links to terrorism do not end there. In a 2017 paper by Kyle Shideler, Sarah Froehlke and Susan Fischer for the Center For Security Policy, Eid Charity’s managing director Ali bin Abdullah al-Suwaidi, is named as one of 59 individuals designated as terror financiers by the Arab coalition. The same paper names Hashim al-Awadhy, an Eid Charity official, as an individual currently designated a terrorist by Saudi Arabia, the UAE, Egypt, and Bahrain. The paper continues:

Beginning in 2010, Eid Charity worked with and funded Abd al-Wahhab al-Humayqani and his charity organization in Yemen. In 2013, the United States Department of Treasury labeled Humayqani as a Specially Designated Global Terrorist (SDGT) citing that his charity organization was being used as a channel for al-Qaeda.

Now that we have established that Eid Charity and its founder are heavily linked to terrorism, let’s come back to Nigeria. In February 2022, the Middle East Forum reached out to me with the leaked data, in case I was interested in taking a look at Eid Charity’s activities in Africa. The translated Excel spreadsheet file alone contained over 2GB worth of data, showing over 45,800 transfers from Eid Charity to obscure organisations everywhere from Mauritania to Indonesia, Pakistan, Kenya, Ghana and Niger.

And of course, Nigeria.

Over $12m to be exact, spread out across 2,620 transfers between 2007 and 2019. Below is an overview of the global donation data arranged in descending order of total donation size.

The main data file showing the entire global donation footprint of Eid Charity is available here, but if you’re reading this on a phone, I really wouldn’t recommend opening it. It will probably crash your device, such is its sheer size. I extracted the dataset for Nigeria and uploaded it as a more readable PDF here. Feel free to zoom in for enhanced readability.

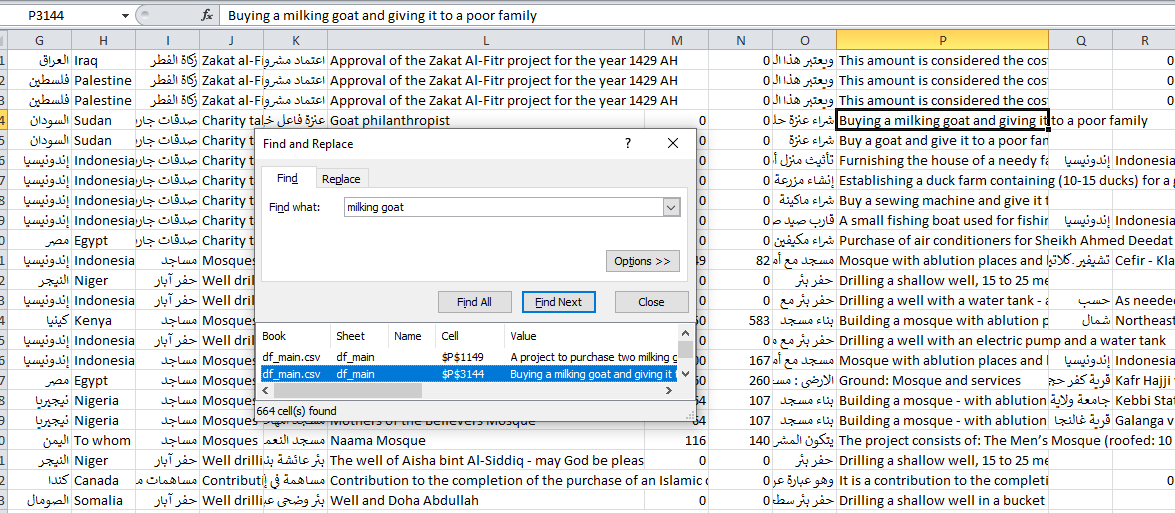

The data bears unmistakable fingerprints of tactics used by terror financiers, money launderers and other entities with an interest in concealing or obfuscating the true purpose of a money transfer. For example, thousands of transfers to different organisations in different countries on different continents have near-identical descriptions such as “Buying a milking goat for a needy family,” “Building a mosque,” “Buying a sewing machine,” “Drilling a well,” and “Prize money for Qur’anic recital.”

The phrase “Buying a milking goat” appears with minor variations 664 times across multiple donations to different groups in different geographical areas and cultures - including places where goat milk is hardly a dietary staple.

The connection to Nigerian banking raises its head when the identities of the 2 Nigerian beneficiary organisations are examined - Al-Furqan Charitable Foundation and a certain “Grass Albar Foundation.” The former appears to be twinned to a Pakistani organisation with the same name, which also appears multiple times across the 45,000+ transaction records. The Pakistani organisation by the way, has been designated a terrorist entity for supporting Taliban militants in Afghanistan.

No such evidence seems to exist against its Nigerian twin however. Its only electronic footprint - an abandoned Facebook page - appears benign, unless you count this little rendezvous with our old friends from Cornflakes For Jihad, Jama'atu Izalatil Bid'ah Wa Iqamatus Sunnah also known as the Izala Society

The second beneficiary however, is where all the KYC, AML and CFT alarm bells go off. First of all, “Grass Albar Foundation” appears to be completely nonexistent. For months I have searched through every database that exists in Nigeria and even enlisted help from friends in DC and London, in case some mention of this mysterious charity pops up. There has been not a single hit. This organisation, which the data shows, received just under $12m from a known Qatari terrorism financier between 2007 and 2019, apparently has no record of existence in Nigeria.

This raises a plethora of questions. Since these were all electronic transactions with a paper trail, where did the money go? How was an organisation without CAC (or any other) registration apparently able to open a corporate domiciliary account and receive money from Qatar for at least 12 years? Which banks enabled this? How much of this money possibly ended up in the hands of terrorists across Nigeria? How many more such clandestine funding arrangements still exist within Nigeria’s fraud-ridden banking system?

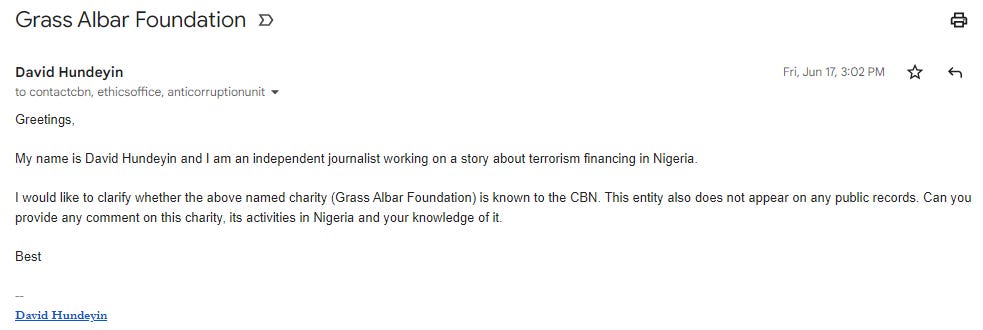

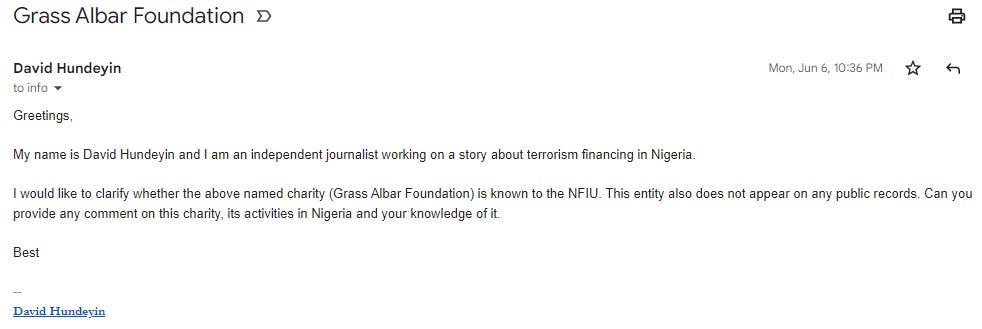

I reached out to the CBN, EFCC and NFIU for clarification on these questions.

As always, they had nothing to say.

They never have anything to say.

So many shady deals going on with which Nigeria banks are enablers, same with providing a safe haven for fraudsters and terror financing in Nigeria. Thank you David, you're doing a great job only that the authority that ought to take actions are part of it. We hope a New Nigeria will be birthed with Peter Obi and Datti Ahmed and you in charge of Efcc.

Thanks for the enlightenment David. Very much appreciated.